ü

| | | 18 | Insperity | 2017 Proxy Statement

|

| | | | ü | | Hedging policy prohibitsprohibiting employees and directors from engaging in hedging transactions involving shares of our common stock | ü

| | Pledging policy prohibits employees and directors from engaging in pledging transactions involving shares of our common stock that would be considered significant by the Board | ü

| | A lead independent director | ü

| | Compensation Committee composed entirely of outside, independent directors | ü

| | Independent compensation consultant hired by and reporting directly to the Compensation Committee |

| | | | 16 | Insperity | 2018 Proxy Statement |

What Insperity does not have: | | | | | û | | Employment agreements with NEOs or other executive officers | û

| | Executive pension or other similar retirement or supplemental benefits | û

| | Single trigger change in control agreements for NEOs | û

| | Tax gross-ups in the event of a change in control | û

| | Medical coverage for retirees | û

| | Excessive benefits and perquisites |

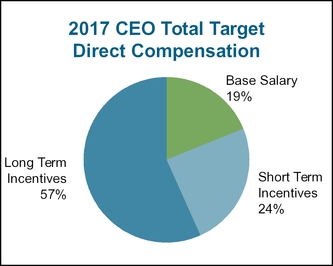

Summary of Compensation Elements We provide our NEOs with a mixture of pay linked to Companycompany and individual performance. The major elements of our 20162017 annual compensation package for NEOs are summarized in the following chart. | | | | | | | | | Compensation Element | | Form of Compensation | | Purpose | | Fixed | Base Salary | | Cash | | Provides fixed level of compensation to attract and retain talent | | Variable and at Risk | Variable Cash Compensation (Insperity Annual Incentive Program) | | Cash | | Rewards executive officers for achieving annual Company, departmental and individual performance goals | | Long-Term Equity Incentives | | Restricted Stock and Performance Shares | | Supports long-term focus on creating stockholder value, provides strong retention incentive with multi-year vesting and rewards achievement of long-term performance goals | | Benefits | Retirement Benefits | | 401(k) Plan | | Provides competitive retirement benefits as part of comprehensive pay package | | Health & Welfare Benefits | | Medical, Dental, Life and Disability Benefits | | Provides competitive health and welfare benefits as part of comprehensive pay package |

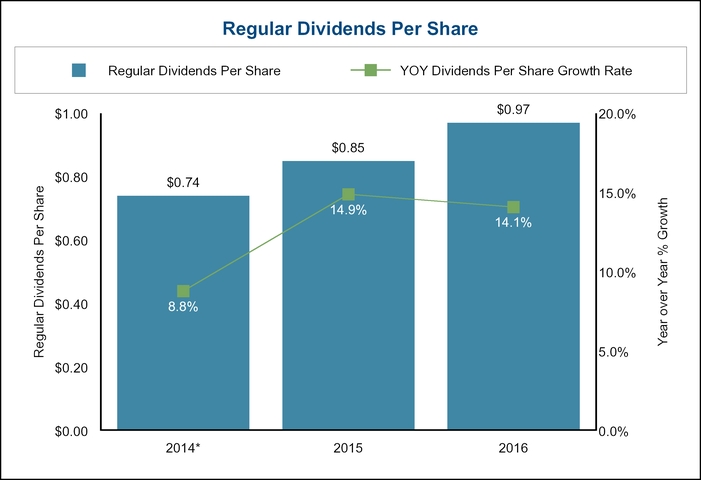

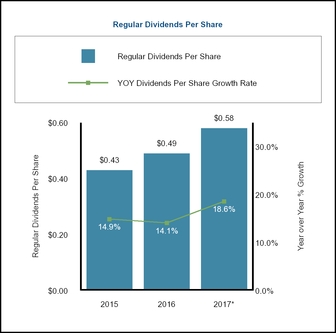

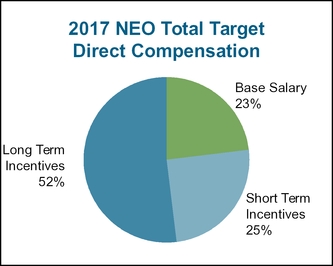

ElementsAs illustrated in the charts below, approximately 81% of Compensationthe CEO’s target direct compensation and 77% of the NEOs target direct compensation, on average, is in the form of performance-based compensation.

| | | Insperity | 2018 Proxy Statement | 17 |

Base Salary Base salary is intended to provide fixed annual compensation to attract and retain talented executive officers. Annual adjustments to base salary are based upon the annual performance evaluation, market data and other relevant considerations. Annual performance appraisals are completed through Our NEOs were awarded merit salary increases during the first quarter of 2017 as follows: | | | | | | | | | 2016 | | 2017 | | 2017 | | | Base Salary | | Base Salary | | Increase | | Chief Executive Officer and Chairman of the Board | $884,000 | | $920,000 | | 4.1% | | Chief Financial Officer, Senior Vice President of Finance and Treasurer | $432,480 | | $460,000 | | 6.4% | | President | $513,760 | | $535,000 | | 4.1% | | Chief Operating Officer and Executive Vice President of Client Services | $513,760 | | $535,000 | | 4.1% | | Executive Vice President of Sales & Marketing | $490,880 | | $511,000 | | 4.1% |

The average base salary increase for our talent management system, which evaluatesNEOs in 2017 was 4.6%. The increases in base salary were based on the executive officer’s annual performance based on pre-established competenciesreviews, the findings of a compensation study conducted in the Fall of 2016 (“Study”) by the Compensation Committee’s former independent compensation consultant, Meridian Compensation Partners, LLC and other factors deemed relevant by the achievement of specific individualCompensation Committee, such as Company performance goals. Competencies for executive officers include business ethics, continuous learning, integrity, managing customer focus, strategic thinking and visionary leadership.

| | | Insperity | 2017 Proxy Statement

| 19 |

general economic conditions.

Variable Cash Compensation Variable cash compensation places a significant portion of executive compensation at risk and is tied to corporate, departmental and individual performance. Variable compensation for all executive officers is paid through the Insperity Annual Incentive Program (“Cash Incentive Program”), a cash incentive program under the stockholder-approved 2012 Incentive Plan. The Cash Incentive Program embodies our pay-for-performance philosophy and helps align executive officers’ compensation to the Company’s overall performance, as well as to their respective individual performance and the performance of the departments under their respective supervision. Cash Incentive Program Target Bonus Percentage The Compensation Committee approved the target bonus percentage for each executive officer (other than the CEO) based on the CEO’s recommendations. His recommendations took into account the executive officer’s level of responsibility, market conditions and internal equity considerations. The Compensation Committee also evaluated the foregoing factors in determining the CEO’s target bonus percentage. Because executive officers are in a position to directly influence the overall performance of the Company, and in alignment with our pay-for-performance philosophy, we believe that a significant portion of their total cash compensation should be at risk. The CEO, the individual with the greatest overall responsibility for Company performance, was granted a larger incentive opportunity in comparison to his base salary in order to weight his overall pay mix more heavily towards performance-based compensation than the overall pay mix of the other executive officers. The CFO, who had less responsibility for overall Company operating performance relative to other NEOs, was granted a smaller incentive opportunity in comparison to his base salary in order to weight his overall pay mix less heavily towards performance-based compensation than the overall pay mix of the other NEOs. For 2017, the Compensation Committee set the annual incentive targets as a percentage of each NEO’s base salary as follows:

| | | | 18 | Insperity | 2018 Proxy Statement |

| | | | | Target Bonus Percentage under Cash Incentive Program | | Chief Executive Officer and Chairman of the Board | 130% | | Chief Financial Officer, Senior Vice President of Finance and Treasurer | 90% | | President | 100% | | Chief Operating Officer and Executive Vice President of Client Services | 100% | | Executive Vice President of Sales & Marketing | 100% |

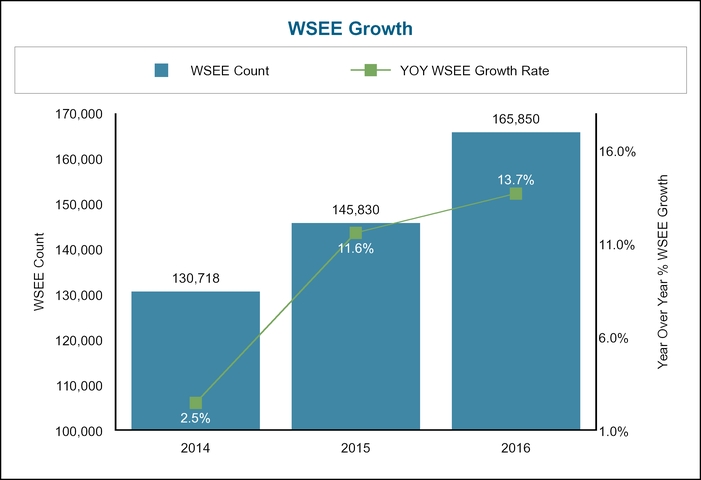

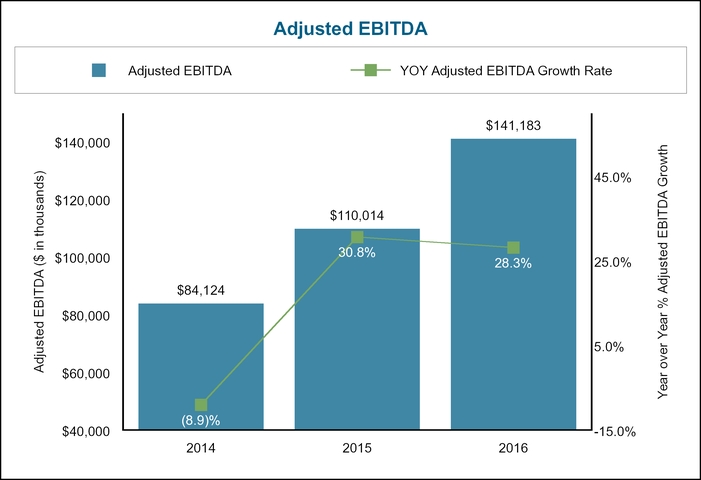

Calculation and Weighting of Performance Components For 2017, the target variable compensation under the Cash Incentive Program for the CEO was based on corporate and individual performance components and for all other NEOs was based on corporate, departmental and individual performance components. Corporate performance goals for 2017 were based on adjusted EBITDA (“Adjusted EBITDA”), year-over-year growth in the number of paid worksite employees (“PWEE Growth”) and gross profit contribution from mark-up and business performance solutions per worksite employee per month (“GPC per WEE per Month”). For the CEO, variable compensation was heavily weighted toward corporate performance to align his Cash Incentive Program bonus opportunity with Company-wide performance. Each performance component is determined separately and is not dependent on the other components, except that if an executive officer’s individual performance rating is below the threshold, then that executive officer would receive no Cash Incentive Program bonus, regardless of corporate and departmental performance. Each executive officer’s Cash Incentive Program bonus is the sum of the result of each performance component. For all executive officers, 20% of the Cash Incentive Program target was weighted toward individual performance to reflect their individual performance during the year. A departmental component was included in the Cash Incentive Program bonus of each executive officer (other than the CEO) to encourage him or her to provide effective leadership to the departments under his or her supervision, as well as to align the interests of the executive with those of the employees that he or she supervises. Each performance component was weighted for each NEO as follows: | | | | | | | | | | | | | | | | | | | | | | Corporate Performance | | | | | | Total of All Components | | | | Adjusted EBITDA | | PWEE Growth | | GPC per WEE per Month | | Departmental | | Individual | | | Chief Executive Officer and Chairman of the Board | | 32% | | 32% | | 16% | | 0% | | 20% | | 100% | | Chief Financial Officer, Senior Vice President of Finance and Treasurer | | 20% | | 20% | | 10% | | 30% | | 20% | | 100% | | President | | 24% | | 24% | | 12% | | 20% | | 20% | | 100% | | Chief Operating Officer and Executive Vice President of Client Services | | 24% | | 24% | | 12% | | 20% | | 20% | | 100% | | Executive Vice President of Sales & Marketing | | 24% | | 24% | | 12% | | 20% | | 20% | | 100% |

Annual Bonus Metrics Support Strong Returns to Stockholders The Compensation Committee has historically established a variety of annual performance goals designed to create a strong alignment between executive and stockholder interests. The Compensation Committee selects corporate performance goals that are aligned with the Company’s business strategy and objectives. When achieved, the corporate performance goals contribute to the overall success of the Company and enhance stockholder value. The Compensation Committee sets each corporate performance goal to be challenging and rigorous, requiring the attainment of predetermined achievement levels before triggering a payout to the executives.

| | | Insperity | 2018 Proxy Statement | 19 |

| | | | | Annual Bonus Metric | Definition | Rationale | Adjusted EBITDA1 | In setting our Adjusted EBITDA performance goal, the Compensation Committee chose to exclude the following items from EBITDA (earnings before interest, taxes, depreciation, and amortization), to the extent applicable:

(1) non-cash impairment charges; (2) stock-based and incentive compensation; (3) professional advisory fees and outside costs related to stockholder matters; and (4) other extraordinary, unusual or infrequent items. | We have included Adjusted EBITDA as one of our corporate performance goals because we believe it is a key indicator of our overall productivity; effective management of pricing, direct costs and operating expenses; and ability to grow the business while favorably balancing profitability.

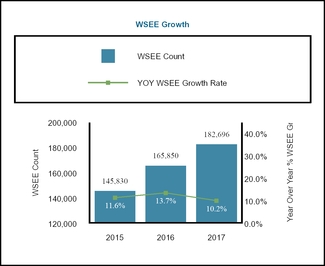

| | Paid Worksite Employee (PWEE) Growth | The PWEE Growth corporate component of Cash Incentive Program bonuses was determined by calculating the year-over-year growth in the number of paid worksite employees for calendar year 2017 and year-over-year growth as of January 2018 compared to January 2017, with the final payout amount being based upon the period that produced the greatest percentage payout of the target bonus. We included the number of paid worksite employees for January 2018 in the performance period to reflect the results of our annual Fall Sales Campaign and significant year-end client renewal period. | We included PWEE Growth as a component in order to focus our NEOs on growing our business. Increasing the number of paid worksite employees is a key metric for measuring the success of our sales operations and client retention efforts and is a significant driver in our overall growth and performance. | | Gross Profit Contribution per WEE per Month | Gross profit from our service fee and other products and services offerings expressed on a per worksite employee per month basis. | We included this component as a corporate performance goal because the margin on our service fee and other contributing products and services is an important driver of our overall profitability. | | Departmental Component | The specific departmental goals for each Named Executive Officer have been outlined in the section below labeled “Departmental Component Performance” | Departmental goals were developed by each department and were designed to encourage employees to work together to continue making business improvements and to increase efficiency, productivity and collaboration across the organization. All departmental goals were approved by the CEO. | | Individual Performance | The annual performance of each Named Executive Officer is evaluated based on pre-established competencies and the achievement of specific individual performance goals. Competencies for executive officers include business ethics, continuous learning, integrity, managing customer focus, strategic thinking and visionary leadership. | Individual performance is included to further individual development and to encourage and measure the executive’s effectiveness in supporting the Company’s commitment to be an industry leader and an employer of choice. |

| | 1 | Adjusted EBITDA under our Cash Incentive Program differs from the definition of adjusted EBITDA we disclose as a Non-GAAP financial measure in Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Non-GAAP Financial Measures” of our annual report on Form 10-K for the year ended December 31, 2017. Under our Cash Incentive Program, we also adjusted our Adjusted EBITDA for incentive compensation expense. |

| | | | 20 | Insperity | 2018 Proxy Statement |

2017 Performance Results Corporate Component The table below shows our corporate component results versus the Company’s 2017 bonus targets. | | | | | | | | | Metric | Performance Goals | Actual Results | Performance Modifier | Threshold

(50% Payout) | Target

(100% Payout) | Stretch

(150% Payout)

| Maximum

(200% Payout)

| | Adjusted EBITDA | $181.3 M | $190.6M | $198.65M | $206.7 | $208.91 | 200% | | PWEE Growth | 11.5% | 12.5% | 13.25% | 14.0% | 11.5% | 50% | | GPC per WSEE per Month | $174 | $176 | $178 | $180 | $176 | 100% |

1 Adjusted EBITDA excludes $2 million in hurricane relief expenses and a gain of $0.2 million in legal settlement proceeds. For all of the metrics above, if actual performance exceeded threshold, but fell in between two performance levels, the performance modifier would be determined by interpolation between the applicable performance levels. Based on the Corporate Performance Modifier results, the payout percentage on the corporate component was 120%. Departmental Component The Departmental Performance Modifier for all executive officers can range from 0% to 150% based on the achievement of departmental goals. If departmental performance was below the threshold, the Departmental Performance Modifier would be 0%, resulting in a departmental component payout of $0. The nature of the departmental goals and objectives for each NEO was as follows: | | | | | | Nature of Departmental Goals and Objectives | | Chief Financial Officer, Senior Vice President of Finance and Treasurer | | Effective management of operating expenses; implementation of Company real estate strategy including effective and efficient management of Company occupancy, development, budgeting and scheduling of additional corporate campus facility; timely due diligence and integration of new products and acquisitions; successful completion of internal audit projects; quality of internal controls; and successful implementation of regulatory initiatives. | | President | | Effective client pricing and renewal activities; effective operating expense management; successful negotiation of certain insurance policies and third party contracts; achievement of strategic business unit financial metrics; effective process and technology enhancements; and successful implementation of certain pricing initiatives. | | Chief Operating Officer and Executive Vice President of Client Services | | Effective client satisfaction and retention; achievement of strategic business unit initiatives and financial metrics; and successful new sales results. | | Executive Vice President of Sales & Marketing | | Achievement of sales lead generation metrics; successful new sales results; expansion of our sales force; and expansion in the number of sales offices. |

In light of the CEO’s assessment of the other NEOs’ performance against the achievement of their departmental goals, the average Departmental Performance Modifier for the other NEOs in 2017 was 137.0%.

| | | Insperity | 2018 Proxy Statement | 21 |

Individual Component The Individual Performance Modifier for all executive officers can range from 0% to 150% based on the executive officer’s individual performance rating resulting from the annual performance appraisal process, as described under “— Variable Cash Compensation — Annual Bonus Metrics Support Strong Returns to Stockholders.” Based on the NEOs’ individual performance ratings, the average Individual Performance Modifier for the NEOs was 144.0%. 2017 Cash Incentive Program Bonus Payouts The executives received bonus payouts in the following amounts based on the weighting for each metric and performance against each objective. | | | | | | | | | Executive | Target Bonus ($) | Corporate Component Payout | Departmental Component Payout | Individual Component Payout | Bonus Payout (% of Target) | Actual Bonus Payout ($) | | Chief Executive Officer and Chairman of the Board | $1,196,000 | $1,139,520 | n/a | $356,100 | 125% | $1,495,620 | | Chief Financial Officer, Senior Vice President of Finance and Treasurer | $414,000 | $245,542 | $184,157 | $110,494 | 130% | $540,193 | | President | $535,000 | $382,259 | $132,729 | $153,965 | 125% | $668,953 | | Chief Operating Officer and Executive Vice President of Client Services | $535,000 | $382,259 | $132,729 | $159,274 | 126% | $674,262 | | Executive Vice President of Sales & Marketing | $511,000 | $365,134 | $150,111 | $141,997 | 129% | $657,242 |

Long-Term Equity Incentive Compensation Long-term equity incentives align the interests of theour executive officers with those of theour stockholders. We believe that long-term incentives enhance retention while rewarding executive officers for achieving long-term performance goals and enhancing stockholder value. Long-term equity incentive awards are made under the stockholder-approved 2012 Incentive Plan. The objectives of the 2012 Incentive Plan are to: | | | | | | | • | | provide incentives to attract and retain persons with training, experience and ability to serve as an executive officer; | | | • | | promote the interests of the Company by encouraging executive officers to acquire or increase their equity interest in the Company; | | | • | | incent executive officers to achieve long-term performance goals and increase stockholder value; | | | • | | provide a means by which executive officers may develop a sense of proprietorship and personal involvement in the development and financial success of the Company; and | | | • | | encourage executive officers to remain with, and devote their best efforts to the business of, the Company, thereby advancing the interests of the Company and our stockholders. |

Awards granted under the 2012 Incentive Plan may be in the form of restricted stock, restricted stock units, stock options, phantom shares, performance shares or units, bonus stock or other incentive awards. In recent years, including 2016, incentive awards to executive officers have been made in the form of restricted stock and performance shares rather than stock options. The 2012 Incentive Plan generally requires all awards of time vested restricted stock be granted with a minimum vesting period of three years for all grants of time vested restricted stock (with limited exceptions for death, disability or change in control), though pro-rata vesting is permissible.

Equity Awards Granted in 2017 In February 2017, the CEO presented to the Compensation Committee his recommendations for long term incentive awards for the other executive officers. His recommendations as to the amount of awards to be granted were

| | | | 22 | Insperity | 2018 Proxy Statement |

based on a number of factors, including, the importance of each executive officer’s role in the Company’s future business operations, equity pay practices of competitor companies, annual expense to the Company of equity awards and the Company’s own past practices in granting equity awards. The Compensation Committee may also grantthen determined and approved the awards with a shorter vesting schedule as an inducement to recruit a new employee or for an award granted in lieu of salary or bonus; however, no such grants were made in 2016.our executive officers, including the CEO, based upon the above noted factors. Under terms of the performance-based long-term equity incentive program, or LTIP, the Compensation Committee determines each calendar year whether to make LTIP awards, which executives will participate, the performance goals and the payout opportunities. Except in the case of a qualifying termination in connection with a change in control, or a termination due to death or disability, a participant in the LTIP must be continuously employed by the Company or its subsidiaries throughout the performance period and on the date such award is paid after the conclusion of the performance period to receive a payout of an award. Awards are granted in the form of phantom shares and will be paid in shares of our common stock, and may include the right to dividend equivalents. | | | | | | | | | | | Executive | Total LTI Grant Date Value | Restricted Stock | | Performance Shares | | Weighting | Shares Granted | Grant Date Value1 | | Weighting | Shares Granted | Grant Date Value2 | | Chief Executive Officer and Chairman of the Board | $3,011,964 | 35% | 22,900 | $968,098 | | 65% | 42,530 | $2,043,866 | | Chief Financial Officer, Senior Vice President of Finance and Treasurer | $769,657 | 55% | 9,430 | $398,653 | | 45% | 7,720 | $371,004 | | President | $1,134,097 | 45% | 11,230 | $474,748 | | 55% | 13,720 | $659,349 | | Chief Operating Officer and Executive Vice President of Client Services | $1,134,097 | 45% | 11,230 | $474,748 | | 55% | 13,720 | $659,349 | | Executive Vice President of Sales & Marketing | $1,134,097 | 45% | 11,230 | $474,748 | | 55% | 13,720 | $659,349 |

| | 1 | The post-split fair value of restricted stock was $42.275 on the grant date. |

| | 2 | The LTIP performance shares are comprised of an adjusted EBITDA performance metric, which represents 70% of the 2017 LTIP Awards, with a post-split fair value of $42.275 and a relative TSR performance metric, which represents 30% of the 2017 LTIP Awards, with a post-split fair value of $61.55. The grant date fair value of the 2017 LTIP Awards assuming achievement of the maximum level of performance are: Mr. Sarvadi - $4,087,732; Mr. Sharp - $742,008; Mr. Rawson - $1,318,698; Mr. Arizpe - $1,318,698; and Mr. Mincks - $1,318,698. Please read Note 10. “Incentive Plans” in our annual report on Form 10-K for the year ended December 31, 2017 filed with the SEC on February 12, 2018 for information regarding fair value of performance awards. |

Awards granted to NEOs under the 2012 Incentive Plan include a “double trigger” requirement in the case of a “change in control” of the Company as defined under the 2012 Incentive Plan. The imposition of a double trigger means that awards granted to NEOs do not immediately vest following a change in control. Under the double trigger, the conditions and/or restrictions that must be met with respect to vesting or exercisability of future awards granted to NEOs will lapse only after a “qualifying termination” within a prescribed number of months following a change in control. All outstanding equity awards held by NEOs include the double trigger requirement. Generally, all equity grants to executive officers are approved solely by the Compensation Committee. If an award is made at a meeting of the Compensation Committee, the grant date is the meeting date or a fixed, future date specified at the time of the grant. Restricted stock and performance awards are valued in accordance with Accounting Standards Codification Topic 718, Compensation-Stock Compensation. ForCompensation. 2017 Restricted Stock Awards The restricted stock options,awards are all subject to a three-year ratable annual vesting schedule and all NEO grants include a “double trigger” requirement in the exercise price cannotcase of a “change in control” of the Company. Following passage of the Tax Cuts and Jobs Act of 2017 (“2017 Tax Act”), the Compensation Committee determined it was in the best interest of the Company and stockholders to accelerate the vesting of restricted stock awards for tranches of the annual grants otherwise scheduled to vest in February or March of 2018, for all employees. All other tranches of the annual restricted stock grants will continue to vest in accordance with the underlying vesting schedule.

| | | Insperity | 2018 Proxy Statement | 23 |

2017 Performance Share Awards The table below outlines the metrics used in our 2017 performance share awards, or LTIP, and the rationale for each metric. | | | | | Performance Share Metric | Definition | Rationale | | Adjusted EBITDA (70% weighting) | EBITDA is adjusted for non-cash impairment charges, stock-based compensation expense, professional advisory fees for stockholder matters, litigation settlements and the associated legal fees, executive severance arrangements and changes in statutory tax rates and assessments. EBITDA is also adjusted to exclude the impact of any divestitures, acquisitions or change in accounting pronouncement that occurs during the performance period. Performance for this metric is assessed for each year within the three-year performance period. | The Compensation Committee elected to use adjusted EBITDA as a performance metric because it is a key indicator of our: (1) overall productivity; (2) effective management of pricing, direct costs and operating expenses; and (3) ability to grow the business while favorably balancing profitability. | | Relative TSR (30% weighting) | RTSR will be measured over the entire 2017-2019 performance period against the performance of 21 peer companies that the Compensation Committee designated as the Company’s 2017 compensation peer group. The EBITDA portion of the 2017 LTIP Awards are subject to a three-year performance period, 2017-2019, with each year being equally weighted for one-third of the target opportunity. | The Compensation Committee elected to use RTSR as a performance metric to further align the long-term financial interests of the executive officers and the Company’s stockholders. |

Recipients can earn 50% of the target number of performance shares if the threshold performance level is achieved and can earn up to 200% of the target number of performance shares if the maximum performance level is achieved. If the performance metric for a performance period falls below the threshold level, no performance shares will be less thancredited for the closing priceperformance period. If actual performance results fall between the threshold, target and maximum performance levels, the number of performance shares earned will be determined by interpolation between the applicable performance levels. Except in the case of a qualifying termination in connection with a change in control, or a termination due to death or disability, a participant in the LTIP must be continuously employed by the Company or its subsidiaries throughout the entire three-year performance period and on the date such award is paid after the conclusion of the performance period to receive a payout of an award. The LTIP awards are payable in shares of our common stock and include dividend equivalents, payable in additional shares of our common stock, with respect to the number of performance shares actually earned pursuant to the LTIP Awards if and to the extent dividends are paid on our common stock during the grant dateperformance period. The performance objectives and stock options may not be re-priced or exchangedpayout percentages for a cash buy-out or settlement with a lower exercise price, without prior stockholder approval.the portion of the first year of the 2017 LTIP Awards subject to the achievement of the adjusted EBITDA performance metric was as follows: We do not provide pension arrangements or nonqualified defined contribution or other deferred compensation | | | | | | | Performance Level | | 2017 Adjusted EBITDA Performance Objective (in millions) | | Payout Percentage | | Below Threshold | | Less Than $162 | | 0% | | Threshold | | $162 | | 50% | | Target | | $167 | | 100% | | Maximum | | $175 | | 200% |

| | | 2024 | Insperity | 20172018 Proxy Statement |

For purposes of the 2017 LTIP Awards, the Compensation Committee certified adjusted EBITDA of $177.7 million for the 2017 performance period. The Compensation Committee determined the LTIP performance modifier to be 200% for the first one-third tranche of the 2017 LTIP Award attributed to adjusted EBITDA. 2016 LTIP Awards The performance objectives and payout percentages for the portion of the second year of the 2016 LTIP Awards subject to the achievement of the adjusted EBITDA performance metric was as follows: | | | | | | | Performance Level | | 2017 Adjusted EBITDA Performance Objective (in millions) | | Payout Percentage | | Below Threshold | | Less Than $149 | | 0% | | Threshold | | $149 | | 50% | | Target | | $166 | | 100% | | Maximum | | $190 | | 200% |

For purposes of the 2016 LTIP Awards, the Compensation Committee certified adjusted EBITDA of $177.7 million for the 2017 performance period. The Compensation Committee determined the LTIP performance modifier to be 149.4% for the second one-third tranche of the 2016 LTIP Award attributed to adjusted EBITDA. 2015 LTIP Awards In March 2015, the Compensation Committee granted awards under the LTIP (the “2015 LTIP Awards”) to the NEOs and certain other officers. The 2015 LTIP Awards are subject to a three-year performance period, 2015-2017, with each year being equally weighted for one-third of the target opportunity. For the 2015 LTIP Awards, the Compensation Committee elected to use increasing levels of EBITDA, with certain pre-defined adjustments, as the performance metric, because it is a key indicator of our: (1) overall productivity; (2) effective management of pricing, direct costs and operating expenses; and (3) ability to grow the business while favorably balancing profitability. For the 2017 performance period, adjusted EBITDA for the 2015 LTIP Awards was generally subject to the same adjustments as the 2017 LTIP Awards. Adjusted EBITDA is a non-GAAP financial measure (for additional information, please see the discussion of Adjusted EBITDA under “— Long-Term Equity Incentive Compensation — Equity Award Granted in 2017”). The 2015 LTIP Awards are payable in shares of our common stock and include dividend equivalents, payable in additional shares of our common stock, with respect to the number of performance shares actually earned pursuant to the 2015 LTIP Awards if and to the extent dividends are paid on our common stock during the performance period. The table below outlines performance achieved for each of the three performance periods within the 2015 LTIP: | | | | | | | | Performance Period | Adjusted EBITDA Goals | Actual Results | Vesting Percentage | | Threshold | Target | Maximum | | 2015 | $101M | $103M | $118M | $110.0M | 145.3% | | 2016 | $106M | $118M | $136M | $141.2M | 200.0% | | 2017 | $111M | $136M | $157M | $177.7M | 200.0% |

| | | Insperity | 2018 Proxy Statement | 25 |

Based upon the vesting percentages above, the executives received payouts in the following amounts: | | | | | | Executive | 2015 Target # of PSUs | PSU Payout Multiplier | 2015 Earned Amounts | | Chief Executive Officer and Chairman of the Board | 60,700 | 181.8% | 110,333 | | Chief Financial Officer, Senior Vice President of Finance and Treasurer | 10,600 | 181.8% | 19,268 | | President | 22,700 | 181.8% | 41,262 | | Chief Operating Officer and Executive Vice President of Client Services | 22,700 | 181.8% | 41,262 | | Executive Vice President of Sales & Marketing | 22,700 | 181.8% | 41,262 |

Other Compensation Elements Retirement Benefits We do not provide pension arrangements or nonqualified defined contribution or other deferred compensation plans for our executive officers. Our executive officers are eligible to participate in the Company’s corporate 401(k) plan, which is generally available to all full-time Company employees.plan. Each payroll period, we contribute on behalf of each eligible participant a matching contribution equal to 100% of the first 6% of compensation contributed to the 401(k) plan by the participant (subject to applicable limitations under the Internal Revenue Code). Supplemental Benefits, Including Management Perquisites Executive compensation also includes supplemental benefits and a limited number of perquisites that enhance our ability to attract and retain talented executive officers. We believe that perquisites assist in the operation of business, allowing executive officers more time to focus on business objectives. Supplemental benefits and perquisites include the following: (1) an automobile for business and personal use (executive officers are taxed on their personal use); (2) a supplemental executive disability income program that provides disability income of 75% of an executive officer’s total cash compensation up to $20,000$23,333 per month; and (3) an executive wellness program. In addition to the foregoing perquisites, our executive officers participate in the annual Chairman’s Trip. The annual Chairman’s Trip is provided for sales representatives meeting a certain sales target and the spouses of those sales representatives. We believe that our executive officers should be part of the trip to recognize these outstanding employees of the Company. We strongly encourage our executive officers to bring their spouses to further our vision of being an employer of choice and to build relationships that contribute to retention. We pay the associated income taxes related to the trip on behalf of our employees and executive officers. Compensation Governance Stockholder Advisory Votes At the 20162017 Annual Meeting of Stockholders, the stockholders approved, in a non-binding advisory vote, the compensation of our NEOs, with over 84%98% of the votes cast in favor of such compensation. The Compensation Committee values the opinions expressed by our stockholders and considered input from stockholders, including the vote outcome, when it made compensation decisions for our executive officers for fiscal year 2017.2018. Role of Management in Setting Compensation The recommendations of the CEO play a significant role in the Compensation Committee’s determination of compensation matters related to the other NEOs, each of whom report directly to the CEO. On an annual basis, the CEO makes recommendations to the Compensation Committee regarding such components as salary adjustments, target annual incentive opportunities and the value of long-term incentive awards. In making his recommendations, the CEO reviews the performance of each of the other NEOs based upon the core competencies of business ethics, continuous learning, integrity, managing customer focus, strategic thinking and visionary leadership, market data for similar positions and other factors deemed relevant in reviewing each executive officer’s performance. The Compensation Committee

| | | | 26 | Insperity | 2018 Proxy Statement |

takes the CEO’s recommendation under advisement, but makes all final decisions regarding each NEO’s compensation. The CEO does not make a recommendation with respect to his own compensation. The CEO typically attends Compensation Committee meetings, but he is excused from any meeting when the Compensation Committee deems it advisable to meet in executive session or when the Compensation Committee meets to discuss items that would impact the CEO’s compensation. The CEO’s compensation is reviewed and discussed by the Compensation Committee and his performance is evaluated at least annually. The Compensation Committee makes all final compensation decisions for each of our NEOs, including the CEO. Role of the Compensation Committee in Setting Compensation The Compensation Committee is responsible for designing, implementing and administering our executive compensation programs and, in doing so, the Compensation Committee is guided by the compensation philosophy stated above. The Compensation Committee reviews and approves total compensation for our NEOs through a comprehensive process that includes: | | | | | • | | selecting and engaging an external, independent consultant; | | • | | reviewing and selecting companies to be included in our peer group; | | • | | reviewing market data on all major elements of executive compensation; | | • | | reviewing alignment of executive compensation and incentive goals with stockholder value; and | | • | | reviewing performance results against corporate, departmental and individual goals. |

| | | Insperity | 2017 Proxy Statement

| 21 |

A complete listing of our Compensation Committee’s responsibilities is included in the Compensation Committee’s charter, which is available for review on our corporate website at www.insperity.com in the Corporate Governance section under the Investor Relations tab. Role of the Compensation Consultants in the Compensation Process The Compensation Committee’s charter provides that it has the sole authority to retain and terminate any compensation consultant to assist in maintaining compensation practices in alignment with our compensation goals. The Compensation Committee believes that outside consultants are an efficient way to keep current on executive compensation trends and stay abreast of competitive compensation practices. In 2015,2017, the Compensation Committee engaged Meridian Compensation Partners LLC (“Meridian”)FW Cook to replace its former outside consultant. MeridianFW Cook had not been previously retained by the Compensation Committee or the Company, and has not received any remuneration from the Company, directly or indirectly, other than for advisory services rendered to, or at the direction of, the Compensation Committee or the Board. The Compensation Committee has reviewed Meridian’sFW Cook’s independence and determined that MeridianFW Cook is an independent advisor with no conflicts of interest with us (as determined under Rule 10C-1(b)(4)(i) of the Exchange Act). Assessing External Market Compensation Practices At the direction of the Compensation Committee, we periodically conduct an executive compensation study that compares each executive officer’s compensation to market data for similar positions. While the Compensation Committee does not target our executive officers’ pay to any particular level (such as a target percentile) of comparative market data contained in executive compensation studies, such data help to inform and influence pay decisions and are considered by the Compensation Committee in meeting our compensation program objectives as described above. Selecting a peer group to benchmark compensation for our executives presents certain challenges, including the limited number of publicly-traded PEOs and the Company’s unique business model. As one of the largest PEO service providers in the United States, our direct PEO service competitors include TriNet Group, Inc., a national PEO, and the PEO divisions of Automatic Data Processing, Inc. and Paychex, Inc., which are significantly larger business service companies. The delivery of our PEO services and our other business performance solutions requires a variety of professional services, human resources, information technology services and software. These areas represent important components of our overall service offerings, and we compete for talent with many companies offering similar services or products. Our peer group includes a number of these companies. Consistent with our historical position, we do not view traditional staffing companies as competitors for business or talent and have not included such companies in our compensation peer group. We do not provide leased employees or staffing employees to clients, and in 2010 incurred significant expense and undertook significant re-branding efforts to change our name to Insperity in part to avoid any confusion with traditional staffing companies. In 2015, the Compensation Committee retained Meridian to conduct a compensation study (the “Study”) as part

| | | Insperity | 2018 Proxy Statement | 27 |

The selection process for the Compensation Peer Group took into account multiple factors, including: industry (with an emphasis on outsourced human resources services, including our PEO competitors), comparable revenue range, comparable market capitalization, comparable business complexity and risk, and the extent to which each company may compete with Insperity for executive talent. As part of the Study process, the 2016 Compensation Peer Group was expanded from sixteen to twenty-one companies and there was significant turnover in the prior year compensation peer group, with six former peer group members being replaced by eleven new peer group companies. For 2016,2017, the Compensation Peer Group included the following companies:

| | | 22 | Insperity | 2017 Proxy Statement

|

| | | | | | | Company Name | | Company Ticker | | Providers of PEO Services | Automatic Data Processing, Inc. | | ADP | | Paychex, Inc. | | PAYX | | TriNet Group, Inc. | | TNET | | IT Services and Software | Convergys Corporation | | CVG | | DST Systems, Inc. | | DST | | Genpact Limited | | G | | Hackett Group, Inc. | | HCKT | | MoneyGram International, Inc. | | MGI | | Unisys Corporation | | UIS | | Web.com Group, Inc. | | WEB | | Professional Services | CEB Inc.1 | | CEB | | CBIZ, Inc. | | CBZ | | The Dun & Bradstreet Corporation | | DNB | | FTI Consulting, Inc. | | FCN | | GP Strategies Corporation | | GPX | | Heidrick & Struggles International, Inc. | | HSII | | Korn/Ferry International | | KFY | | Navigant Consulting, Inc. | | NCI | | Resources Connection, Inc. | | RECN | | WageWorks, Inc. | | WAGE | Willis Towers Watson PLC1 | | WLTW |

1 Towers Watson & Company merged with Willis Group HoldingsCEB, Inc. was acquired on January 4, 2016.April 6, 2017 by Gartner, Inc. The Study examined market compensation data for executive positions based on a combination of proxy data and public disclosures of the Compensation Peer Group. In addition to the results of the compensation Study, conducted by Meridian, internal factors are also an important consideration when determining each executive officer’s compensation. These factors include:

| | | | | | | • | | the executive officer’s performance review conducted by either the Compensation Committee (for the CEO) or the CEO (for all other executive officers); | | | • | | the CEO’s recommendations regarding the other executive officers; | | | • | | the executive officer’s tenure with the Company, industry experience and ability to influence stockholder value; and | | | • | | the importance of the executive officer’s position to the Company in relation to the other executive officer positions within the Company. |

| | | Insperity | 2017 Proxy Statement

| 23 |

2016 Executive Compensation Decisions

Base Salary Changes

The Company awarded merit salary increases during the first quarter of 2016 to our NEOs as follows:

| | | | | | | | | 2015 | | 2016 | | 2016 | | | Base Salary | | Base Salary | | Increase | | Chief Executive Officer and Chairman of the Board | $850,000 | | $884,000 | | 4.0% | | Chief Financial Officer, Senior Vice President of Finance and Treasurer | $408,000 | | $432,480 | | 6.0% | | President | $494,000 | | $513,760 | | 4.0% | | Chief Operating Officer and Executive Vice President of Client Services | $494,000 | | $513,760 | | 4.0% | | Executive Vice President of Sales & Marketing | $472,000 | | $490,880 | | 4.0% |

The average base salary increase for our NEOs in 2016 was 4.4%. The increases in base salary were based on the annual performance reviews, the findings of the Study and other factors deemed relevant by the Compensation Committee, such as Company performance and general economic conditions.

Cash Incentive Program Target Bonus Percentage

The Compensation Committee approved the target bonus percentage for each executive officer (other than the CEO) based on the CEO’s recommendations. His recommendations took into account the executive officer’s level of responsibility, market conditions and internal equity considerations. The Compensation Committee also evaluated the foregoing factors in determining the CEO’s target bonus percentage. Because executive officers are in a position to directly influence the overall performance of the Company, and in alignment with our pay-for-performance philosophy, we believe that a significant portion of their total cash compensation should be at risk. The CEO, the individual with the greatest overall responsibility for Company performance, was granted a larger incentive opportunity in comparison to his base salary in order to weight his overall pay mix more heavily towards performance-based compensation than the overall pay mix of the other executive officers. The CFO, who had less responsibility for overall Company operating performance relative to other NEOs, was granted a smaller incentive opportunity in comparison to his base salary in order to weight his overall pay mix less heavily towards performance-based compensation than the overall pay mix of the other NEOs. For 2016, the Compensation Committee set the annual incentive targets as a percentage of each NEO’s base salary as follows:

| | | | | Target Bonus Percentage under Cash Incentive Program | Chief Executive Officer and Chairman of the Board | 130% | Chief Financial Officer, Senior Vice President of Finance and Treasurer | 85% | President | 100% | Chief Operating Officer and Executive Vice President of Client Services | 100% | Executive Vice President of Sales & Marketing | 100% |

Calculation and Weighting of Performance Components

For 2016, the targeted variable compensation under the Cash Incentive Program for the CEO was based on corporate and individual performance components and for all other NEOs was based on corporate, departmental and individual performance components. Corporate performance goals for 2016 were based on adjusted EBITDA (“Adjusted EBITDA”), year-over-year growth in the number of paid worksite employees (“PWEE Growth”) and operating expense savings over our Board approved 2016 budget (“OES”). For the CEO, variable compensation was heavily weighted toward corporate performance to align his Cash Incentive Program bonus opportunity with Company-wide performance. For all executive officers, 20% was weighted toward individual performance to reflect their individual performance during the year. A departmental component was included in the Cash Incentive Program bonus of each executive officer (other than the CEO) to encourage him or her to provide effective leadership to the departments under his or her supervision, as

| | | 24 | Insperity | 2017 Proxy Statement

|

well as to align the interests of the executive with those of the employees that he or she supervises. Each performance component is determined separately and is not dependent on the other components, except that if an executive officer’s individual performance rating is below the threshold, then that executive officer would receive no Cash Incentive Program bonus, regardless of corporate and departmental performance. Each executive officer’s Cash Incentive Program bonus is the sum of the result of each performance component.

Each performance component was weighted for each NEO as follows:

| | | | | | | | | | | | | | | | | | | | | | Corporate Performance | | | | | | Total of All Components | | | | Adjusted EBITDA | | PWEE Growth | | OES | | Departmental | | Individual | | | Chief Executive Officer and Chairman of the Board | | 32% | | 32% | | 16% | | 0% | | | 20% | | 100% | | Chief Financial Officer, Senior Vice President of Finance and Treasurer | | 20% | | 20% | | 10% | | 30% | | | 20% | | 100% | | President | | 24% | | 24% | | 12% | | 20% | | | 20% | | 100% | | Chief Operating Officer and Executive Vice President of Client Services | | 24% | | 24% | | 12% | | 20% | | | 20% | | 100% | | Executive Vice President of Sales & Marketing | | 24% | | 24% | | 12% | | 20% | | | 20% | | 100% |

2016 Corporate Performance Goals

Adjusted EBITDA Corporate Component

We have included Adjusted EBITDA as one of our corporate performance goals because we believe it is a key indicator of our overall productivity; effective management of pricing, direct costs and operating expenses; and ability to grow the business while favorably balancing profitability. In setting our Adjusted EBITDA performance goal, the Compensation Committee chose to exclude the following items from EBITDA, to the extent applicable: (1) non-cash impairment charges; (2) stock-based and incentive compensation expense; (3) professional advisory fees and outside costs related to stockholder matters; and (4) other extraordinary, unusual or infrequent items. Adjusted EBITDA under our Cash Incentive Program differs from the definition of adjusted EBITDA we disclose as a Non-GAAP financial measure in Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Non-GAAP Financial Measures” of our annual report on Form 10-K for the year ended December 31, 2016. Under our Cash Incentive Program, we also adjusted our Adjusted EBITDA for incentive compensation expense.

The Adjusted EBITDA Corporate Performance Modifier was determined as follows:

| | | | | | Performance Level | | 2016 Adjusted EBITDA | | Adjusted EBITDA Corporate

Performance Modifier

| Below Threshold | | Less than $151 million | | 0% | Threshold | | $151 million | | 50% | Target | | $165 million | | 100% | Stretch | | $180 million | | 150% | Maximum | | $195 million | | 200% |

If actual performance exceeded threshold, but fell in between two performance levels, the Adjusted EBITDA Corporate Performance Modifier would be determined by interpolation between the applicable performance levels. The Company’s 2016 Adjusted EBITDA after excluding (1) stock-based and incentive compensation expense, and (2) stockholder advisory expenses of $0.3 million was $164.6 million. Based on this performance, the Compensation Committee determined the Adjusted EBITDA Corporate Performance Modifier to be 99% for each NEO.

| | | Insperity | 2017 Proxy Statement

| 25 |

PWEE Growth Corporate Component

We also chose the year-over-year growth percentage in the number of paid worksite employees, as a 2016 corporate performance goal. We included this as a component in order to focus our NEOs on growing our business. Increasing the number of paid worksite employees is a key metric for measuring the success of our sales operations and client retention efforts and is a significant driver in our overall growth and performance.

The PWEE Growth corporate component of Cash Incentive Program bonuses was determined by calculating the year-over-year growth in the number of paid worksite employees for calendar year 2016 and year-over-year growth as of January 2017 compared to January 2016, with the final payout amount being based upon the period that produced the greatest percentage payout of the target bonus. We included the number of paid worksite employees for January 2017 in the performance period to reflect the results of our annual Fall Sales Campaign and significant year-end client renewal period.

The PWEE Growth Corporate Performance Modifier was determined as follows:

| | | | | | | Performance Level | | Calendar Year Year-over-Year or January 2017 Growth Percentage | | PWEE Growth Corporate Performance Modifier | | Below Threshold | | Less than 13% | | 0% | | Threshold | | 13% | | 50% | | Target | | 14% | | 100% | | Stretch | | 15% | | 150% | | Maximum | | 16% | | 200% |

If actual performance exceeded threshold, but fell in between two performance levels, the PWEE Growth Corporate Performance Modifier would be determined by interpolation between the applicable performance levels. During the performance period, the year-over-year growth percentage in the number of worksite employees was highest for the calendar year period and was 13.7%. Based on this performance, the Compensation Committee determined the PWEE Growth Corporate Performance Modifier to be 86% for each NEO.

OES Corporate Component

We also included OES as a 2016 corporate performance goal. We believed that a heightened focus on financial stewardship throughout the entire Company was warranted, and that successful achievement of this goal would require the combined focus and effort of employees across all departments and help create value for our stockholders. In setting our OES performance goal, the Compensation Committee chose to exclude the following items from OES, to the extent applicable: (1) stock-based and incentive compensation expense; (2) professional advisory fees and outside costs related to stockholder matters; and (3) other extraordinary, unusual or infrequent items. OES under our Cash Incentive Program differs from the definition of adjusted operating expenses we disclose as a Non-GAAP financial measure in Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Non-GAAP Financial Measures” of our annual report on Form 10-K for the year ended December 31, 2016. Under our Cash Incentive Program, we also adjusted our OES for stock-based compensation expense and incentive compensation expense. The OES Corporate Performance Modifier was determined as follows:

| | | | | | Performance Level | | Operating Expense Savings Over 2016 Budget | | OES Corporate

Performance Modifier | Below Threshold | | - | | 0% | Threshold | | $0 million | | 50% | Target | | $1.5 million | | 100% | Stretch | | $3.5 million | | 150% | Maximum | | $5.5 million | | 200% |

If actual performance exceeded threshold, but fell in between two performance levels, the OES Corporate Performance Modifier would be determined by interpolation between the applicable performance levels. The Company’s 2016 OES, excluding (1) stock-based and incentive compensation expense, and (2) stockholder advisory expenses of $0.3 million, was $5.7 million. Based on this performance, since OES was greater than the maximum performance

| | | 26 | Insperity | 2017 Proxy Statement

|

threshold of $5.5 million, the Compensation Committee approved an OES Corporate Performance Modifier of 200% for each NEO.

Departmental Component

Departmental goals were developed by each department and were designed to encourage employees to work together to continue making business improvements and to increase efficiency, productivity and collaboration across the organization. All departmental goals were approved by the CEO. As part of our continued focus on managing operating expenses, we did not include a stretch goal or maximum performance level for 2016; therefore, the target level also constituted the maximum level achievable for Cash Incentive Program bonus purposes. The Departmental Performance Modifier for all executive officers can range from 0% to 100% based on the achievement of departmental goals. If departmental performance was below the threshold, the Departmental Performance Modifier would be 0%, resulting in a departmental component payout of $0. The nature of the departmental goals and objectives for each NEO was as follows:

| | | | | | Nature of Departmental Goals and Objectives | Chief Financial Officer, Senior Vice President of Finance and Treasurer | | Effective management of operating expenses; implementation of Company real estate strategy including effective and efficient management of Company occupancy, development, budgeting and scheduling of additional corporate campus facility; timely due diligence and integration of new products and acquisitions; successful completion of internal audit projects; quality of internal controls; and successful implementation of regulatory initiatives. | President | | Effective client pricing and renewal activities; effective operating expense management; successful negotiation of certain insurance policies and third party contracts; achievement of strategic business unit financial metrics; effective process and technology enhancements; and successful implementation of certain pricing initiatives. | Chief Operating Officer and Executive Vice President of Client Services | | Effective client satisfaction and retention; achievement of strategic business unit initiatives and financial metrics; effective operating expense management; and successful new sales results. | Executive Vice President of Sales & Marketing | | Achievement of sales lead generation metrics, successful new sales results; effective operating expense management; expansion of sales force management; and successful SaaS unit growth. |

In light of the CEO’s assessment of the other NEOs’ performance against the achievement of their departmental goals, the average Departmental Performance Modifier for the other NEOs in 2016 was 82.3%.

Individual Component

The Individual Performance Modifier for all executive officers can range from 0% to 150% based on the executive officer’s individual performance rating resulting from the annual performance appraisal process, as described under “— Base Salary.” Based on the NEOs’ individual performance ratings, the average Individual Performance Modifier for the NEOs was 141.0%.

The Compensation Committee reserves the right to pay discretionary bonuses to executive officers outside of the Cash Incentive Program. While the Compensation Committee may exercise such discretion in appropriate circumstances, no discretionary bonuses have been awarded to our NEOs in recent years.

2016 Equity Grants

In February 2016, the CEO presented to the Compensation Committee his recommendations for awards of restricted stock for the other executive officers. His recommendations as to the amount of awards to be granted were based on a number of factors, including, the importance of each executive officer’s role in the Company’s future business operations, equity pay practices of competitor companies, annual expense to the Company of equity awards and the

| | | Insperity | 2017 Proxy Statement

| 27 |

Company’s own past practices in granting equity awards. In March 2016, the Compensation Committee then determined and approved the awards for our executive officers, including the CEO, based upon the above noted factors. For 2016, our NEOs were granted the following restricted stock awards:

| | | | | | | | Name | | Shares of Restricted Stock | | Grant Date Value of Restricted Stock1 | | Paul J. Sarvadi | | 15,575 |

| | $804,605 | | Douglas S. Sharp | | 6,580 |

| | $339,923 | | Richard G. Rawson | | 7,920 |

| | $409,147 | | A. Steve Arizpe | | 7,920 |

| | $409,147 | | Jay E. Mincks | | 7,920 |

| | $409,147 |

1 The fair market value of one share of our common stock on the grant date was $51.66.

The restricted stock awards are all subject to a three-year ratable annual vesting schedule and all NEO grants include a “double trigger” requirement in the case of a “change in control” of the Company.

In March 2016, the Compensation Committee also granted performance awards under the LTIP (“2016 LTIP Awards”) to our NEOs and certain other officers. In granting the 2016 LTIP Awards, the Compensation Committee decreased the long-term incentive weighting of the time vested restricted stock and increased the weighting assigned to performance awards for the recipients of those awards. For 2016, the long-term incentive compensation awards were allocated between performance awards and time-vested restricted stock on approximately a 70% and 30% basis for the CEO, a 50% and 50% basis for the CFO, and a 60% and 40% basis for the remaining NEOs. In establishing the performance metrics for the 2016 LTIP Awards, the Compensation Committee retained a metric tied to achieving increased levels of EBITDA with certain pre-defined adjustments, but also added a relative total shareholder return metric (“RTSR”).

The Compensation Committee elected to use adjusted EBITDA as a performance metric because it is a key indicator of our: (1) overall productivity; (2) effective management of pricing, direct costs and operating expenses; and (3) ability to grow the business while favorably balancing profitability. For this 2016 LTIP metric, EBITDA is adjusted for non-cash impairment charges, stock-based compensation expense, professional advisory fees for stockholder matters, litigation settlements and the associated legal fees, executive severance arrangements and changes in statutory tax rates and assessments. EBITDA is also adjusted to exclude the impact of any divestitures, acquisitions or change in accounting pronouncement that occurs during the performance period. The Adjusted EBITDA performance metric for the 2016 LTIP Awards is the same non-GAAP financial measure disclosed in Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Non-GAAP Financial Measures” of our annual report on Form 10-K for the year ended December 31, 2016.

The Compensation Committee elected to use RTSR as a performance metric to further align the long-term financial interests of the executive officers and the Company’s stockholders. The 2016 LTIP Awards are weighted at 60% for the EBITDA performance metric and 40% for the RTSR performance metric. RTSR will be measured over the entire 2016-2018 performance period against the performance of 21 peer companies that the Compensation Committee designated as the Company’s 2016 compensation peer group. The EBITDA portion of the 2016 LTIP Awards are subject to a three-year performance period, 2016-2018, with each year being equally weighted for one-third of the target opportunity. The 2016 LTIP Awards are payable in shares of our common stock and include dividend equivalents, payable in additional shares of our common stock, with respect to the number of phantom shares actually earned pursuant to the 2016 LTIP Awards if and to the extent dividends are paid on our common stock during the performance period.

| | | 28 | Insperity | 2017 Proxy Statement

|

The aggregate number of 2016 LTIP Awards granted by the Compensation Committee to each NEO if all of the target performance metrics are achieved was as follows:

| | | | | | | | | Aggregate Number of Performance Shares (at Target) | Grant Date Value of Performance Shares1 (at Target) | | Chief Executive Officer and Chairman of the Board | | 36,345 |

| $2,149,007 | | Chief Financial Officer, Senior Vice President of Finance and Treasurer | | 6,580 |

| $389,062 | | President | | 11,880 |

| $702,441 | | Chief Operating Officer and Executive Vice President of Client Services | | 11,880 |

| $702,441 | | Executive Vice President of Sales & Marketing | | 11,880 |

| $702,441 |

| | 1

| The fair value of the adjusted EBITDA performance metric, which represents 60% of the 2016 LTIP Awards, was $51.66. The fair value of the RTSR performance metric, which represents 40% of the 2016 LTIP Awards, was $70.33. The grant date fair value of the 2016 LTIP Awards assuming achievement of the maximum level of performance are: Mr. Sarvadi - $4,298,014; Mr. Sharp - $778,124; Mr. Rawson - $1,404,881; Mr. Arizpe - $1,404,881; and Mr. Mincks - $1,404,881. Please read Note 11. “Incentive Plans” in our annual report on Form 10-K for the year ended December 31, 2016 filed with the SEC on February 13, 2017 for information regarding fair value of performance awards. |

Recipients can earn 50% of the target number of phantom shares if the threshold performance level is achieved and can earn up to 200% of the target number of phantom shares if the maximum performance level is achieved. If the performance metric for a performance period falls below the threshold level, no performance shares will be credited for the performance period. If actual performance results fall between the threshold, target and maximum performance levels, the number of performance shares earned will be determined by interpolation between the applicable performance levels.

The performance objectives and payout percentages for the portion of the first year of the 2016 LTIP Awards subject to the achievement of the adjusted EBITDA performance metric was as follows:

| | | | | | | Performance Level | | 2016 Adjusted EBITDA Performance Objective (in millions) | | Payout Percentage | | Below Threshold | | Less Than $134 | | 0% | | Threshold | | $134 | | 50% | | Target | | $144 | | 100% | | Maximum | | $166 | | 200% |

For purposes of the 2016 LTIP Awards, the Compensation Committee certified adjusted EBITDA of $141.2 million for the 2016 performance period. After interpolation, the Compensation Committee determined the LTIP performance modifier to be 85.9% for the first one-third tranche of the 2016 LTIP Award attributed to adjusted EBITDA. To receive the awards, the recipients must remain continuously employed by us throughout the entire three-year performance period and as of the date the Compensation Committee certifies the final results, with limited exceptions for death, disability or change in control.

2015 LTIP Awards

In March 2015, the Compensation Committee granted awards under the LTIP (the “2015 LTIP Awards”) to the NEOs and certain other officers. The 2015 LTIP Awards are subject to a three-year performance period, 2015-2017, with each year being equally weighted for one-third of the target opportunity. For the 2015 LTIP Awards, the Compensation Committee elected to use increasing levels of EBITDA, with certain pre-defined adjustments, as the performance metric, because it is a key indicator of our: (1) overall productivity; (2) effective management of pricing, direct costs and operating expenses; and (3) ability to grow the business while favorably balancing profitability. For the 2016 performance period, adjusted EBITDA for the 2015 LTIP Awards was subject to the same adjustments as the 2016 LTIP Awards. Adjusted EBITDA is a non-GAAP financial measure (for additional information, please see the discussion of Adjusted EBITDA under “— 2016 Executive Compensation Decisions — 2016 Equity Grants”). The 2015 LTIP Awards are payable in shares of our common stock and include dividend equivalents, payable in additional shares of our common stock, with respect to

| | | Insperity | 2017 Proxy Statement

| 29 |

the number of phantom shares actually earned pursuant to the 2015 LTIP Awards if and to the extent dividends are paid on our common stock during the performance period.

The second one-third tranche of the 2015 LTIP Awards was subject to achievement of the adjusted EBITDA performance metric and corresponding performance level payout percentages as follows:

| | | | | | | Performance Level | | 2016 Adjusted EBITDA Performance Objective (in millions) | | Payout Percentage | | Below Threshold | | Less Than $106 | | 0% | | Threshold | | $106 | | 50% | | Target | | $118 | | 100% | | Maximum | | $136 | | 200% |

Based upon 2016 adjusted EBITDA of $141.2 million, the Compensation Committee determined the LTIP performance modifier to be 200% for the second one-third tranche of the 2015 LTIP Awards.

With regard to the first one-third tranche of the 2015 LTIP Awards, the Compensation Committee previously determined the LTIP performance modifier to be 145.3% based upon a 2015 adjusted EBITDA of $110.0 million.

To receive the awards, the recipients must remain continuously employed by us throughout the entire three-year performance period and as of the date the Compensation Committee certifies the final results, with limited exceptions for death, disability or change in control.

Other Policies

Stock Ownership Guidelines To further align the interests of the CEO and non-employee directors with those of our stockholders, the Board has adopted stock ownership guidelines for the Company. The stock ownership guidelines provide that the CEO is required to own three times his annual base salary in our common stock and all non-employee directors are required to own three times their annual cash retainer in our common stock. Stock ownership includes direct stock ownership but does not include unvested stock awards or unexercised stock options. The Company annually monitors and calculates the stock ownership level of each individual, and each individual has five years to meet the applicable ownership requirements. The CEO is in compliance and each non-employee director is in compliance or is expected to be in compliance within the applicable time period.

| | | | 28 | Insperity | 2018 Proxy Statement |

Employment Agreements, Post-Employment and Change in Control Compensation Our executive officers are employed at will and none have an employment agreement. We do not provide the executive officers with any kind of contractual severance. Equity awards granted to executive officers do not automatically accelerate upon a change in control. Rather such awards contain a “double trigger” requiring a qualifying termination within a prescribed number of months following the change in control in order to accelerate vesting. All outstanding equity awards held by our NEOs are subject to the double trigger requirement. Incentive Compensation Recoupment Policy (“Clawback Policy”) In February 2014, the Board adopted a recoupment policy for incentive compensation paid to executive officers and other employees. The Clawback Policy authorizes the Company to recover excess incentive compensation paid to an executive officer who engaged in, or was aware of and failed to report, fraud or misconduct which results in a restatement of our financial statements. Incentive compensation paid under the Cash Incentive Program and LTIP is subject to the Clawback Policy. Risk Assessment The Company conducted an assessment of our compensation programs and practices for its employees and determined that there are no risks arising from such compensation programs and practices that are reasonably likely to have a material adverse effect on the Company. In arriving at this determination, some of the key risk mitigators included independent review by departments not participating in the compensation program, internal audit review, maintenance of

| | | 30 | Insperity | 2017 Proxy Statement

|

a whistleblower line, and external auditor review. Deductibility of Compensation Section 162(m) of the Internal Revenue Code imposes a $1 million limit on the amount that a public company may deduct for compensation paid to its principal executive officer or any of its three other most highly compensated executive officers employed as of the end of the year (other than the principal executive officer or the principal financial officer). This limitation does not apply to compensation that is paid only if the executive officer’s performance meets pre-established objective goals based on performance criteria approved by stockholders. We strive to take action, where possible and considered appropriate, to preserve the deductibility of compensation paid to our executive officers. We have also awarded compensation that might not be fully tax deductible when such grants were nonetheless in the best interest of the Company and our stockholders. Subject to the requirements of Section 162(m), we generally will be entitled to take tax deductions relating to compensation that is performance-based, which may include cash incentives, stock options and other performance-based awards. Under the 2017 Tax Act, effective for our taxable year beginning January 1, 2018, the exception under Section 162(m) for performance-based compensation will no longer be available, subject to transition relief for certain grandfathered arrangements in effect as of November 2, 2017. In addition, the covered employees will be expanded to include our CFO, and once one of our NEOs is considered a covered employee, the NEO will remain a covered employee so long as he or she receives compensation from us. Given the lack of regulatory guidance to date, the Compensation Committee is not yet able to determine the full impact of the 2017 Tax Act changes to Section 162(m) on the Company and our compensation programs.

| | | Insperity | 2018 Proxy Statement | 29 |

Compensation Committee Report We have reviewed and discussed the Compensation Discussion and Analysis contained in this proxy statement with management. Based on such review, we recommended to the Board that the Compensation Discussion and Analysis be included in this proxy statement for filing with the SEC. The foregoing report is provided by the following directors, who are members of the Compensation Committee: COMPENSATION COMMITTEE Michael W. Brown,Timothy T. Clifford, Chairperson

Timothy T. CliffordCarol R. Kaufman

Peter A. Feld

Michelle McKenna-DoyleNorman R. Sorensen

Compensation Committee Interlocks and Insider Participation During 2016, Dr. Eli Jones2017, among our current directors, Mr. Clifford, Ms. Kaufman and Messrs. Brown and FeldMr. Sorensen served on the Compensation Committee prior to the 2016 Annual Meeting of Stockholders, and Mr. Brown, Mr. Feld and Ms. McKenna-Doyle served on the Compensation Committee after the 2016 Annual Meeting of Stockholders, with Mr. Clifford also joining the Compensation Committee upon his appointment to the Board in October 2016.Committee. None of the members of the Compensation Committee is currently or has been at any time one of our officers or employees. None of our executive officers currently serves, or has served during the last year, as a member of the board of directors or compensation committee of any other entity that has one or more executive officers serving as a member of the Board or the Compensation Committee.

| | | | 30 | Insperity | 20172018 Proxy Statement | 31 |

SUMMARY COMPENSATION TABLE The table below summarizes the total compensation paid or earned by the CEO, chief financial officer and each of the three other most highly compensated executive officers of the Company for services rendered in all capacities to the Company during 2017, 2016 2015 and 2014.2015. We have not entered into any employment agreements with any of our NEOs. The compensation plans under which the grants in the following tables were made are generally described in the Compensation Discussion and Analysis section, and include the Cash Incentive Program the 2001 Incentive Plan and the 2012 Incentive Plan, which provide for, among other things, restricted stock grants and LTIP performance awards. | | | | | | | | | | | | | | | | | | Name and Principal Position | | Year | | Salary

($) | | Stock

Awards ($)1 | | Non-Equity Incentive

Plan Compensation ($)2 | | All Other Compensation ($)3 | | Total

($) | Paul J. Sarvadi, Chief Executive Officer and Chairman of the Board | | 2016 | | 884,000 | | 2,953,612 |

| | 1,369,078 |

| | 33,231 |

| | 5,239,921 | | | 2015 | | 850,000 | | 2,653,896 |

| | 1,657,500 |

| | 240,522 |

| | 5,401,918 | | | 2014 | | 850,000 | | 1,096,000 |

| | 988,637 |

| | 497,445 |

| | 3,432,082 | Douglas S. Sharp, Chief Financial Officer, Senior Vice President of Finance and Treasurer | | 2016 | | 432,480 | | 728,985 |

| | 411,422 |

| | 56,250 |

| | 1,629,137 | | | 2015 | | 408,000 | | 692,160 |

| | 455,705 |

| | 78,204 |

| | 1,634,069 | | | 2014 | | 396,000 | | 383,600 |

| | 331,572 |

| | 124,805 |

| | 1,235,977 | Richard G. Rawson, President | | 2016 | | 513,760 | | 1,111,588 |

| | 570,304 |

| | 63,653 |

| | 2,259,305 | | | 2015 | | 494,000 | | 1,320,840 |

| | 678,188 |

| | 109,064 |

| | 2,602,092 | | | 2014 | | 482,000 | | 657,600 |

| | 464,087 |

| | 237,696 |

| | 1,841,383 | A. Steve Arizpe, Chief Operating Officer and Executive Vice President of Client Services | | 2016 | | 513,760 | | 1,111,588 |

| | 567,249 |

| | 62,239 |

| | 2,254,836 | | | 2015 | | 494,000 | | 1,320,840 |

| | 672,282 |

| | 113,514 |

| | 2,600,636 | | | 2014 | | 482,000 | | 657,600 |

| | 467,921 |

| | 224,498 |

| | 1,832,019 | Jay E. Mincks, Executive Vice President of Sales & Marketing | | 2016 | | 490,880 | | 1,111,588 |

| | 549,771 |

| | 65,808 |

| | 2,218,047 | | | 2015 | | 472,000 | | 1,320,840 |

| | 615,902 |

| | 81,965 |

| | 2,490,707 | | | 2014 | | 460,000 | | 657,600 |

| | 437,296 |

| | 211,367 |

| | 1,766,263 |

| | | | | | | | | | | | | | | | | | Name and Principal Position | | Year | | Salary

($) | | Stock

Awards ($)1 | | Non-Equity Incentive

Plan Compensation ($)2 | | All Other Compensation ($)3 | | Total

($) | Paul J. Sarvadi, Chief Executive Officer and Chairman of the Board | | 2017 | | 920,000 | | 3,011,964 |

| | 1,495,620 |

| | 51,533 |

| | 5,479,117 | | | 2016 | | 884,000 | | 2,953,612 |

| | 1,369,078 |

| | 33,231 |

| | 5,239,921 | | | 2015 | | 850,000 | | 2,653,896 |

| | 1,657,500 |

| | 240,522 |

| | 5,401,918 | Douglas S. Sharp, Chief Financial Officer, Senior Vice President of Finance and Treasurer | | 2017 | | 460,000 | | 769,657 |

| | 540,193 |

| | 64,140 |

| | 1,833,990 | | | 2016 | | 432,480 | | 728,985 |

| | 411,422 |

| | 56,250 |

| | 1,629,137 | | | 2015 | | 408,000 | | 692,160 |

| | 455,705 |

| | 78,204 |

| | 1,634,069 | Richard G. Rawson, President | | 2017 | | 535,000 | | 1,134,097 |

| | 668,953 |

| | 63,679 |

| | 2,401,729 | | | 2016 | | 513,760 | | 1,111,588 |

| | 570,304 |

| | 63,653 |

| | 2,259,305 | | | 2015 | | 494,000 | | 1,320,840 |

| | 678,188 |

| | 109,064 |

| | 2,602,092 | A. Steve Arizpe, Chief Operating Officer and Executive Vice President of Client Services | | 2017 | | 535,000 | | 1,134,097 |

| | 674,262 |

| | 68,096 |

| | 2,411,455 | | | 2016 | | 513,760 | | 1,111,588 |

| | 567,249 |

| | 62,239 |

| | 2,254,836 | | | 2015 | | 494,000 | | 1,320,840 |

| | 672,282 |

| | 113,514 |

| | 2,600,636 | Jay E. Mincks, Executive Vice President of Sales & Marketing | | 2017 | | 511,000 | | 1,134,097 |

| | 657,242 |

| | 62,510 |